On Thursday, stock markets witnessed a notable decline driven by mounting concerns over surging Treasury yields and the looming threat of a government shutdown. Major indexes, including the Dow Jones, S&P 500, and Nasdaq, posted significant losses for the third consecutive day, with the S&P 500 recording its worst session since March. This anxiety was exacerbated by the U.S. 10-year Treasury yield reaching its highest level since 2007 and news of the House going into recess, heightening worries of a government shutdown. The Federal Reserve’s recent announcement of maintaining interest rates but signaling potential future hikes further added to investor unease, particularly regarding prolonged higher interest rates. Tech stocks, such as Tesla and Nvidia, faced substantial declines, while FedEx stood out with strong gains. In the currency markets, the yen emerged as a safe-haven asset, gaining against major currencies amid central banks’ commitment to elevated interest rates, impacting stock markets and risk sentiment.

Stock Market Updates

Stocks experienced a significant decline on Thursday as concerns mounted over rising Treasury yields and the potential for a government shutdown. The Dow Jones Industrial Average dropped by 370.46 points, equivalent to a 1.08% decrease, closing at 34,070.42, while the S&P 500 saw a substantial slide of 1.64% to reach 4,330. The Nasdaq Composite also retreated by 1.82% to end the day at 13,223.98. These losses marked the third consecutive day of declines for these three key indexes, with the S&P 500 recording its worst session since March. Investors were increasingly anxious about the possibility of the Dow and S&P 500 closing the week down by more than 1% and 2%, respectively, while the Nasdaq faced a potential drop of over 3%. Adding to the market’s unease, the U.S. 10-year Treasury yield reached a multiyear high of 4.494%, its highest level since 2007. This surge was fueled by robust labor market data, as weekly jobless claims dropped to 201,000, significantly lower than the expected 225,000 claims, indicating continued strength in the job market. The 2-year yield also soared to 5.202%, levels not seen since 2006, further raising concerns among investors.

Market jitters were exacerbated by news that House Republican leaders had sent the chamber into recess, heightening fears that lawmakers would fail to pass a bill to prevent a government shutdown. Investors worried that such an event could negatively impact fourth-quarter GDP. These developments followed the Federal Reserve’s announcement the previous day, in which it decided to maintain interest rates at their current levels but signaled the possibility of another rate hike before the year’s end. The central bank also hinted at fewer rate cuts in the coming year, reflecting its need to keep rates elevated due to persistent inflation concerns. The clash between market expectations and the actual economic landscape raised concerns among investors, particularly with the prospect of a prolonged period of higher interest rates. Tech stocks, in particular, bore the brunt of these concerns, with companies like Tesla, Alphabet, and Nvidia experiencing declines of over 2%. However, FedEx stood out with a 4.5% gain after reporting better-than-expected earnings for its fiscal first quarter.

Data by Bloomberg

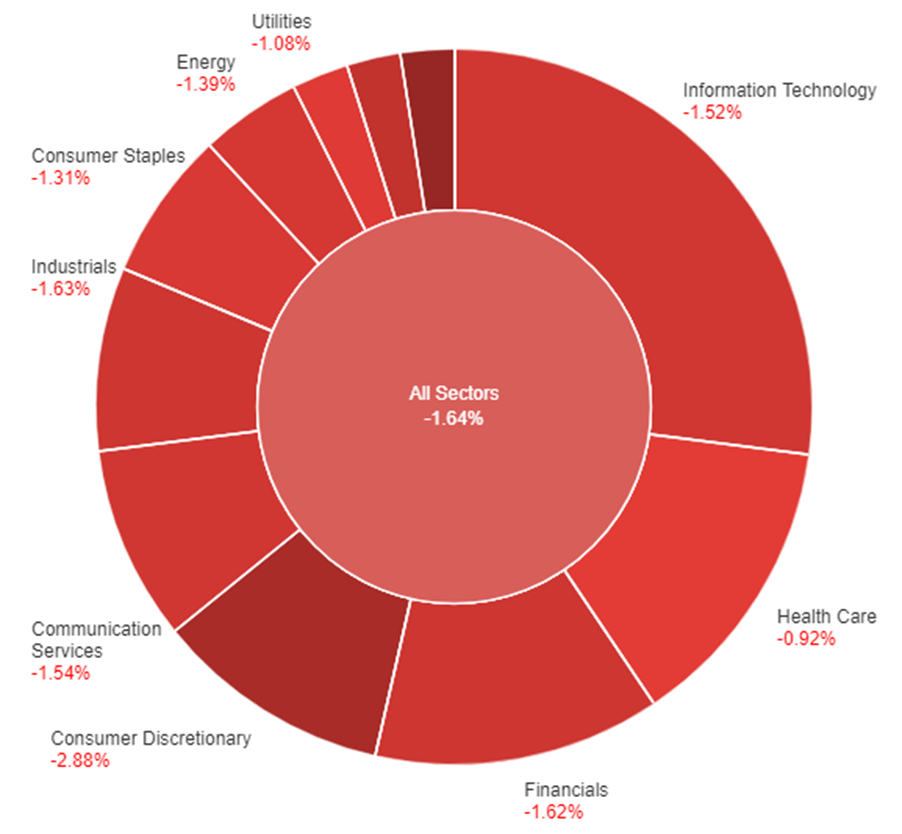

On Thursday, the overall market experienced a decline of -1.64%. Among the various sectors, the Health Care sector performed relatively better with a decrease of -0.92%, while the Real Estate sector saw the largest drop at -3.48%. Other notable sector declines included Consumer Discretionary (-2.88%), Materials (-2.04%), and Information Technology (-1.52%). The Financials sector also faced a notable decrease of -1.62%. In summary, it was a day of general market decline, with Real Estate and Consumer Discretionary sectors being the hardest hit.

Currency Market Updates

In the currency markets, the US dollar index saw a slight retreat after approaching its 2023 peak, primarily due to post-Federal Reserve reactions. EUR/USD remained stable, but USD/JPY and yen crosses experienced declines as risk-off sentiment prevailed. Meanwhile, the British pound weakened after the Bank of England’s somewhat surprising decision to refrain from raising interest rates for the first time since December 2021. EUR/USD dipped to 1.0617, its lowest level since March, before rebounding just above the 38.2% Fibonacci retracement level of the 2022-23 uptrend at 1.0608. This reversal was partly attributed to Treasury yields failing to sustain their recent highs following an unexpected drop in US jobless claims. Additionally, remarks from ECB policymakers about the potential need to raise rates in the upcoming meeting contributed to the market dynamics.

The standout performer of the day was the safe-haven Japanese yen, which gained 0.6% against the US dollar, 0.5% against the euro, and nearly 1% against the British pound and the Australian dollar. The overarching theme in the currency markets was the central banks’ consistent messaging about keeping interest rates at elevated levels for an extended period, leading to a retreat in stock markets and risk appetite. This shift in sentiment prompted investors to turn to the low-yielding yen for carry trades. USD/JPY initially surged to a new 2023 high at 148.465, driven by widening yield spreads between US Treasuries and Japanese government bonds, but later dipped to its lowest level in five days due to risk-off flows. Ongoing efforts by the Japanese Ministry of Finance to support the yen against excessive volatility, coupled with risk management ahead of the Bank of Japan’s meeting and Japan’s CPI report, contributed to the consolidation of the uptrend. Meanwhile, USD/CNH rose slightly as concerns about global growth, prompted by major central banks’ commitment to higher interest rates, led to a decline in Chinese stocks and weighed on copper prices. Looking ahead, the market will closely watch data events such as Japan’s August inflation report, UK retail sales, and global flash PMI readings for September on Friday.

Picks of the Day Analysis

EUR/USD (4 Hours)

EUR/USD Falls as FOMC Meeting Spurs Stronger US Dollar, Fed Signals Hawkish Stance

The EUR/USD experienced a significant decline, dropping from its weekly highs above 1.0730 to 1.0650 in response to the FOMC meeting’s outcome. The Federal Reserve unanimously maintained its interest rate target range at 5.25-5.50%, with minimal changes in the statement compared to the previous month. The Summary of Economic Projections suggests the likelihood of another rate hike by year-end, although Fed Chair Powell emphasized that the dot plot is not a firm plan. The market perceived the meeting as hawkish, causing US bond yields to surge to multi-year highs and Wall Street to turn bearish, subsequently strengthening the US Dollar. Upcoming US data releases and decisions from central banks like the Swiss National Bank and the Bank of England will remain pivotal for market dynamics.

According to technical analysis, the EUR/USD moved in high volatility on Thursday and was able to reach the middle band but then moved back lower and reached the lower band of the Bollinger Bands. This movement suggests the possibility of further consolidation. The Relative Strength Index (RSI) is currently at 37, indicating that the EUR/USD is in a neutral stance with a slight bearish bias.

Resistance: 1.0687, 1.0759

Support: 1.0605, 1.0523

XAU/USD (4 Hours)

XAU/USD Drop Amid Fed’s Hawkish Stance on Rates

Gold prices fell for the third consecutive day, trading around $1,925 during Asia’s early trading hours on Thursday. The US Federal Reserve (The Fed) kept its benchmark interest rate at 5.5%, but projected more rate hikes in 2023, leading to pressure on precious metals. The Fed’s revision of 2024 interest rate projections, from 4.6% to 5.1%, unexpectedly boosted the US Dollar, causing the US Dollar Index (DXY) to reach a six-month high at 105.60. US bond yields also rose, with the 10-year bond hitting 4.43%, its highest since 2007. Precious metals slipped after Fed Chair Jerome Powell’s press conference, where he reiterated The Fed’s commitment to a 2% inflation target and emphasized data-driven future decisions. More US data, including Weekly Jobless Claims, the Philadelphia Fed Manufacturing Survey, and Existing Home Sales Changes, will impact markets on Thursday.

According to technical analysis, XAU/USD moved in high volatility on Thursday and was able to reach the lower band and then move back higher. Currently, the price is trading between the middle and lower bands. The Relative Strength Index (RSI) is currently at 51, indicating that the XAU/USD pair is back in a neutral stance.

Resistance: $1,939, $1,951

Support: $1,922, $1,915

Economic Data

| Currency | Data | Time (GMT + 8) | Forecast |

|---|---|---|---|

| GBP | Retail Sales | 14:00 | 0.5% |

| EUR | French Flash Manufacturing PMI | 15:15 | 46.2 |

| EUR | French Flash Services PMI | 15:15 | 46.0 |

| EUR | German Flash Manufacturing PMI | 15:30 | 39.5 |

| EUR | German Flash Services PMI | 15:30 | 47.2 |

| GBP | Flash Manufacturing PMI | 16:30 | 43.3 |

| GBP | Flash Manufacturing PMI | 16:30 | 49.3 |

| USD | Flash Manufacturing PMI | 21:45 | 48.2 |

| USD | Flash Manufacturing PMI | 21:45 | 50.7 |